AI for Insurance Agents: How to Operationalize It

A typical Monday morning at an agency begins with claim emails piling up as your clients wait for updates that should have gone out hours earlier. Since everything happens in different systems, finding a single answer means opening several tabs and retyping details.

Such a situation drains time, raises stress, and increases the risk of small mistakes that later turn into long calls.

In this article, you’ll learn how AI for insurance works, including its use cases.

TL;DR

- AI for insurance agents automates intake, follow-ups, claims support, and underwriting prep so agents focus on advising, not admin work.

- Machine learning, NLP, and predictive analytics speed up decision-making, flag risks early, and keep outcomes consistent.

- You can use AI for lead qualification, claims triage, underwriting support, and customer support.

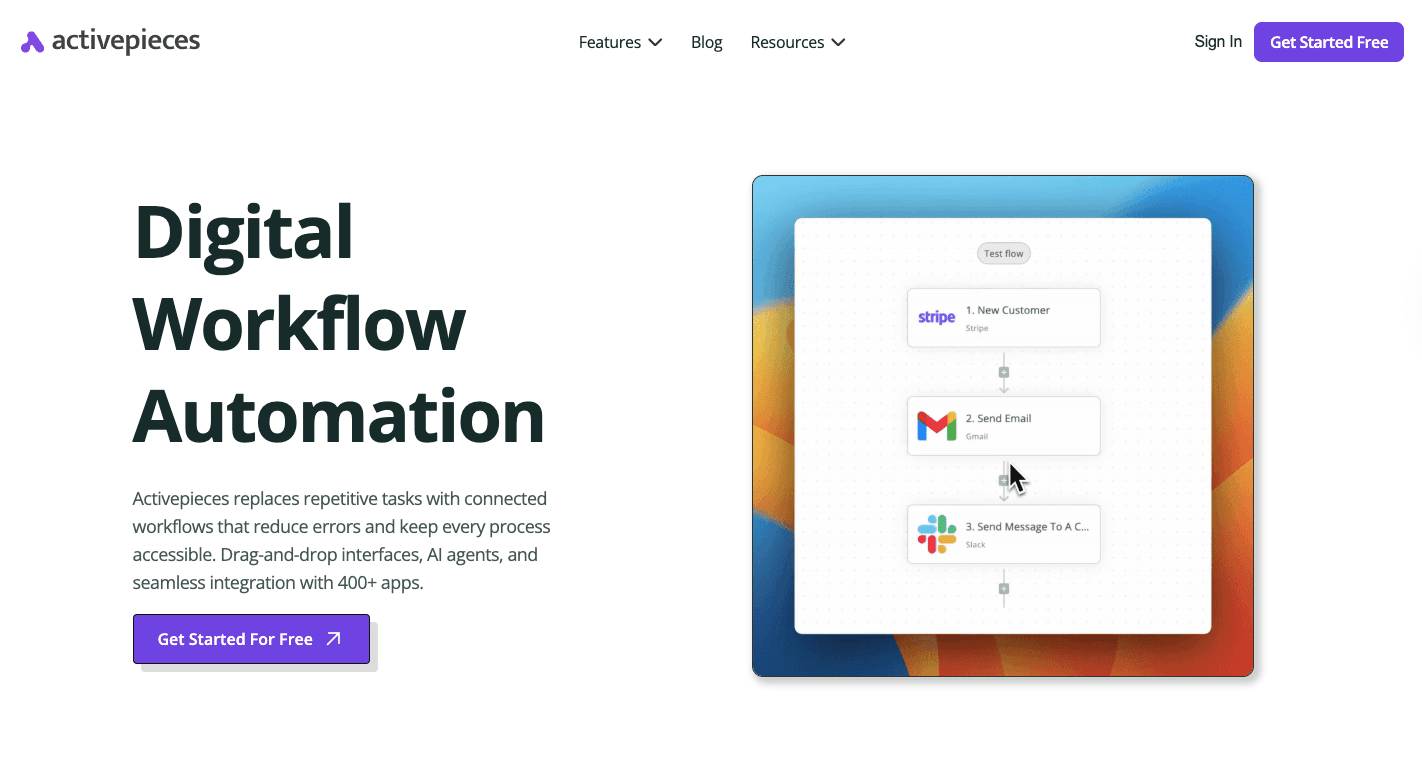

- Activepieces connects AI to insurance systems with 621+ integrations to run controlled, end-to-end workflows.

What Is AI for Insurance Agents?

AI for insurance agents shows up when you work. Software handles repetitive tasks, such as:

- Sorting intake messages

- Pulling details from documents

- Updating records automatically

Sales support highlights potential customers who show real intent and strengthens customer relationships with AI-driven insights.

AI further detects unhappiness signals in emails or calls. Voice-enabled assistants let you ask, “What are Mr. Doe’s coverage limits?” and get the answer on your phone instantly.

Back office checks claims, helps detect fraudulent activities, and supports you as they ensure regulatory compliance.

How Artificial Intelligence Is Used in the Insurance Industry Today

Each area below solves a specific problem insurance agents deal with every week.

Machine Learning

Machine learning (ML) reviews large sets of historical data, then applies those patterns to new submissions. It allows for “Straight-Through Processing,” where simple policies move from application to approval instantly, which leaves only complex or high-value cases for your manual review.

The same systems scan claims data to spot unusual timing, repeated images, or mismatched details, which strengthens fraud detection before payments go out.

Natural Language Processing

Natural language processing (NLP) handles text and speech, which covers most daily insurance work:

- Emails

- Call transcripts

- Policy files

You no longer have to spend hours reading 50-page policy binders or medical records to find one specific limit or exclusion. Virtual assistants answer policy inquiries during phone calls and pull details on demand.

The system also reads tone in messages. It acts as a proactive retention tool by flagging at-risk clients before they even think about cancelling.

Generative AI

Generative AI focuses on writing and summarizing. The days you spent sending the same renewal reminder email to 500 clients are over.

Gen AI tools analyze customer data, such as recent claims, family information, and policy details, to craft personalized emails and messages that sound natural.

These systems also support automating claims processing and improving fraud detection through advanced data analysis. Some teams rely on synthetic data for risk assessment when testing new ideas.

Predictive Analytics

Predictive analytics studies behavior patterns to flag potential risks early. Alerts warn about likely cancellations months before renewal.

Your sales teams see which prospects show real intent. Claims teams, on the other hand, sort new files by severity as soon as clients file claims.

That foresight keeps customer satisfaction steady and reduces operational costs.

Key Benefits of AI Agents for Insurance

Here are the benefits you get when you implement AI:

Reduced Manual Work

Typically, 20 minutes of your time are spent on routine tasks, such as opening tabs and data entry across different systems.

AI can:

- Capture the conversation

- Get names, dates, and policy numbers

- Deliver a completed file ready for review

Now, your human agents can stay focused on judgment and building relationships. Core business processes keep moving automatically as well.

Automated readers also pull the right sections immediately. You stop hunting for information and start analyzing the risk. What took three hours now takes three seconds.

Once documents and calls stay under control, inbox pressure eases. Systems draft replies to routine questions, such as “Can I get a copy of my ID card?”, for approval with a single click. Call summaries save automatically as well, which keeps records clean and leaves you audit-ready.

Faster and More Accurate Decision-Making

Humans are prone to decision fatigue. You make different choices at 4:00 PM on a Friday than at 9:00 AM on a Monday. AI applies the same logic every time.

With hundreds of products across multiple carriers, it’s impossible for you to remember every exclusion and every niche discount. Systems used by insurance brokers compare options instantly, pull data quickly, and surface accurate information.

As those comparisons happen, errors surface sooner. Inconsistencies get flagged, including details a tired human eye might miss at 4:30 PM.

Better Customer Experience and Responsiveness

Faster decisions change how clients feel about your service.

Your clients get their answers at 2:00 AM on a Sunday or during your busiest Monday morning. You move from reactive to always-on without adding a single staff member.

An AI solution tracks customer needs, responds quickly, and maintains a consistent tone. Predictive analytics can monitor external data, such as weather patterns, and internal data, such as smart home sensor data, and prompt outreach before damage spreads.

As updates go out automatically, follow-up calls drop. Personalized service can be delivered to every client.

Higher Agent Productivity and Focus

With fewer interruptions, you can focus more. AI agents act as a force multiplier that lets you manage a book of business that once needed several people.

That support handles questions like “Where is my ID card?” and “I need to pay my bill” independently. Only questions needing further judgment reach you.

During meetings, answers surface live. When someone asks, “Does this cover mold damage in my specific zip code?” the response appears before the sentence ends.

Lower Operational Costs

Manual errors once led to rework, refunds, and unhappy calls days later. Automated checks flag issues early, which improves operational efficiency.

Time once spent fixing problems shifts toward revenue work that increases profitability without lowering service quality.

Common Use Cases for AI for Insurance Agents

Daily work improves when AI supports specific moments where time and attention usually get stretched, such as:

AI for Lead Qualification

As an agent, your most expensive resource is your time. AI steps in early to filter potential customers before they reach you.

Predictive analytics scores leads from 1 to 100 based on intent signals, which come from customer behaviors. The system looks at how long someone spent on the Coverage Options page vs. the homepage, whether they downloaded a whitepaper, or how recent social activity points to a life change.

Once those signals get scored, your customer relationship management (CRM) system automatically sorts your morning task list.

Early outreach happens right away through chat or phone. The AI asks basic qualifying questions like:

- What’s your current coverage?

- Have you had any claims in the last three years?

- What’s your budget range?

During that first interaction, natural language processing detects urgency or frustration with a current provider, which helps you focus on people ready to move.

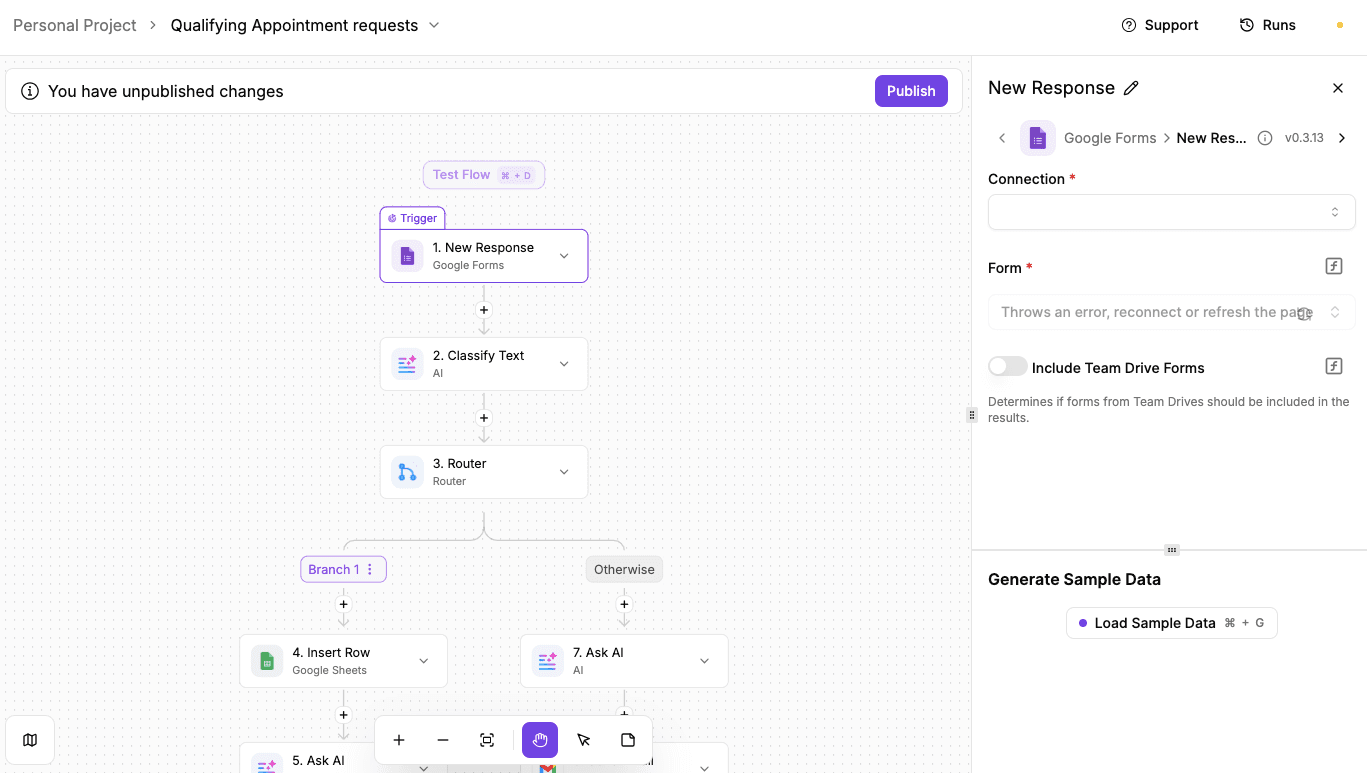

Example: Lead Appointment Qualification

Activepieces automates lead appointment qualification by using AI to classify and handle incoming requests, which makes sure each client is assessed fairly and consistently.

Core components and what they do:

- Triggering the flow: The process starts when a new submission comes in through Google Forms, which collects relevant data for each request.

- AI classification: AI automatically reviews the submission text and classifies the request into categories like “Sales,” “Inquiry,” or “General question.”

- Router for differentiation: Based on the classification, the flow splits into two paths. Sales requests move forward quickly, while other inquiries receive an automated response.

- Handling sales requests: Sales submissions are logged in Google Sheets, a summary is generated using AI, and the information is sent to the assigned salesperson by email for immediate follow-up.

- Handling non-sales requests: Non-sales inquiries are met with AI-generated replies containing relevant resources, sent directly to the lead to provide quick answers.

Try this template: Lead Appointment Qualification

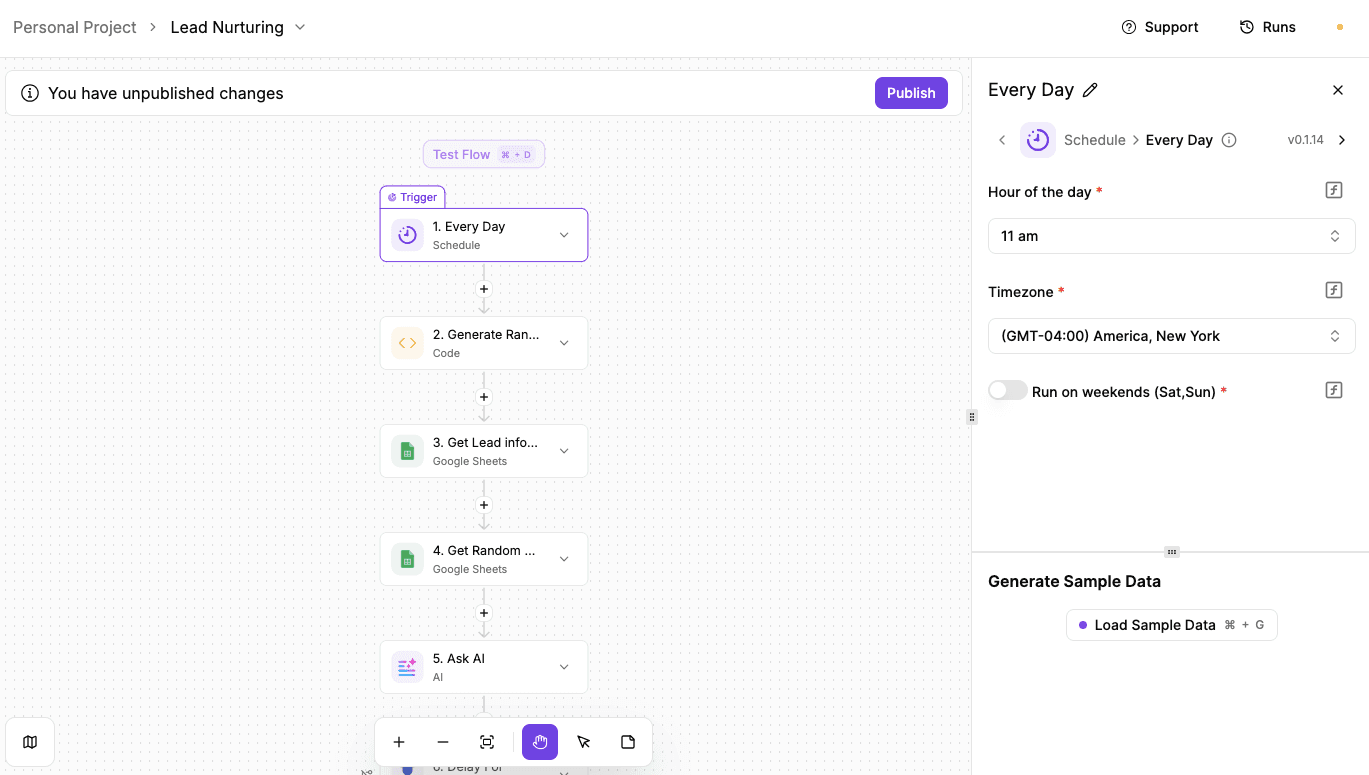

Example: Lead Nurturing

Manual follow-ups often turn into boring “just checking in” emails that get ignored. Sending the same reminder again and again doesn’t build trust or interest.

The lead-nurturing workflow keeps you visible without sounding repetitive or pushy.

Core components and what they do:

- **Scheduled trigger:**The workflow starts with a daily schedule, set for a specific time like 11:00 AM. Each day, the automation runs without manual input.

- Random selection logic: A small AI-generated script creates a random number. That number selects one lead from your lead spreadsheet and one article from your content list.

- **Content source:**The article sheet holds curated resources related to your work, your industry, or lighter content that feels human. You control what goes in.

- AI-written email: Text AI drafts a short email that sounds casual and personal, based on the selected lead and article.

- Send delay: The same random number adds a short delay, so emails don’t always arrive at the exact same time. Messages feel more natural.

- Email delivery: The final step sends the email automatically, which keeps you present without manual follow-ups.

Try this template: Lead Nurturing

AI for Underwriting Support

Many agents spend their time rekeying data from emails, PDFs, and spreadsheets into systems. AI removes that drag by organizing submissions before the review starts.

You no longer waste time googling a prospect. A unified, full risk profile lands in front of you within seconds, which supports underwriting decisions.

Underwriting and claims management stay focused on judgment, especially when property images, location data, and loss history already sit in one place.

AI for Claims Processing and Triage

The AI guides the client through the process with prompts like “Please take a photo of the odometer,” or “Describe the damage to the kitchen.” Claims data arrives structured instead of scattered across emails and voicemails.

Once submitted, claims handling changes pace. Simple cases move forward quickly, while complex ones route to experienced staff.

The system sends automated, personalized messages such as “Hi Sarah, the adjuster has approved the repair. Your check was mailed this morning,” which lowers anxiety during long waits.

AI for Customer Support and Communication

AI helps improve customer interactions by answering customer questions as they come in and guiding customers through the next steps. That support stays available during evenings and weekends, which reduces the backlog during business hours.

Outreach also feels more personal. If a client just bought a new car, the system drafts a note like “Hi Mark, I saw the new SUV! I’ve updated your policy, but did you know your new tech might qualify for a safety discount?”

When a client sends an angry or frustrated email, the AI detects negative sentiment and moves it to the top of your inbox with a “Priority tag,” so you can respond before the issue grows.

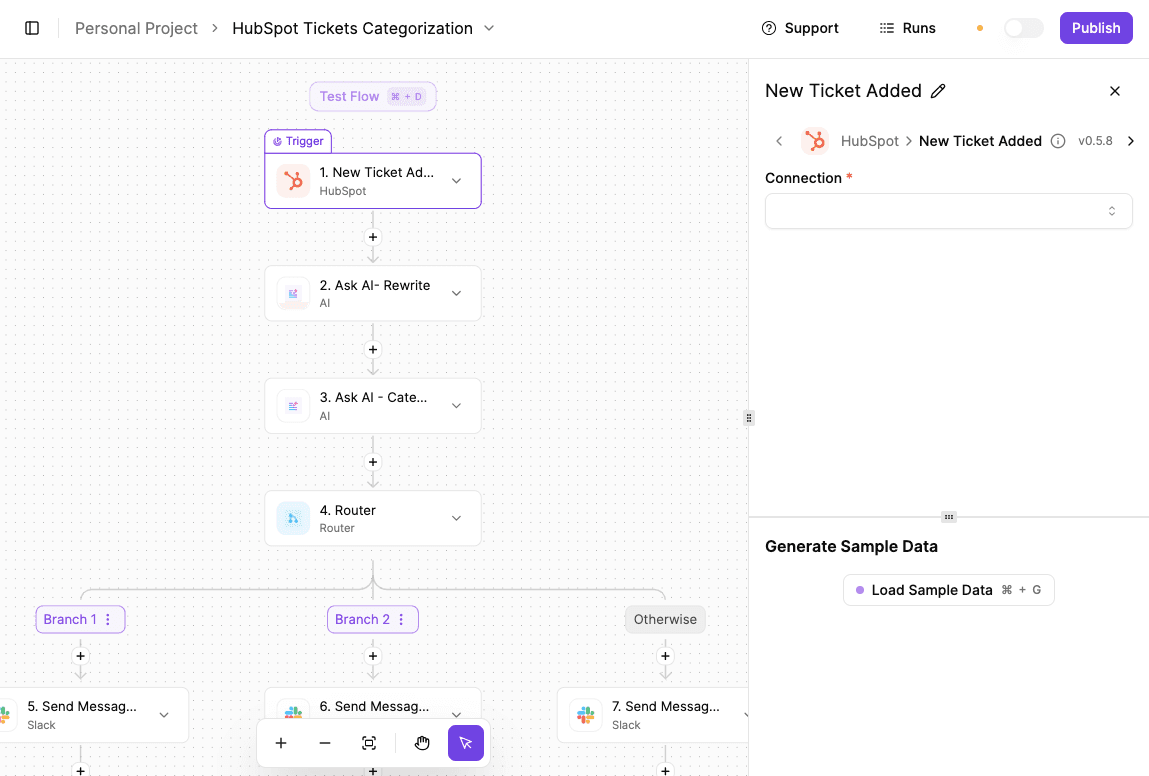

Example: Customer Support Ticketing

When a new customer emails, timing decides the outcome. Waiting too long cools interest, even when the message itself looks good. Writing replies manually slows things down, but sending fully automated responses feels risky.

The customer support ticketing workflow removes that tradeoff by drafting replies instantly and keeping a human in control before anything gets sent.

Core components and what they do:

- Email monitoring trigger: The workflow starts by watching your inbox through a Gmail connection. Every new email triggers the automation the moment it arrives.

- First AI analysis step: The incoming message goes to an AI step that reads the email and figures out what the customer wants, what action makes sense, and what tone fits the situation.

- Second AI writing step: A second AI piece writes the actual reply. The prompt includes clear instructions and examples, so the message sounds professional and moves the conversation forward.

- Human approval via Slack: The drafted reply gets sent to Slack for review. A team member approves it with one click, keeping quality high.

- Conditional routing: If approved, the email goes out automatically. If not, nothing sends, and someone can reply manually.

Try this template: Customer Support Ticketing

How Activepieces Helps You Operationalize AI

AI only helps when it can act on data inside the systems you already use. When tools stay disconnected, insights stay theoretical, and work still happens by hand.

Activepieces is a workflow automation tool that ties automation logic directly to daily insurance operations, so information moves and decisions trigger actions.

Connecting AI to Insurance and Financial Systems

Most insurance companies run on existing software like CRMs, agency management systems, and accounting tools.

As of now, Activepieces provides 621 pre-built pieces that connect these tools together. Those pieces offer seamless integration with AI models, such as ChatGPT or Claude, into the specific insurance software you use every day.

Data remains within your setup, which helps protect sensitive data.

Building End-to-End AI Workflows

Once systems connect, workflows replace manual handoffs. The workflow routes images for analysis, checks carrier rules, updates the claim record, and then sends a status message to the client.

Each step operates in a defined order that you control. Approvals can pause execution when required, or the flow can run fully automated.

Running AI Agents Inside Your Insurance Operations

Inside Activepieces, agents can monitor policy dates, inboxes, and file updates, then act when conditions match. A renewal agent can review recent changes, prepare a summary, and send a meeting request before deadlines pass.

Build AI-Powered Insurance Workflows With Activepieces

Activepieces lets you build AI workflows where decisions trigger actions, so information flows automatically. The logic runs in the background and pauses only when human review is warranted, which makes AI technology practical during busy days.

Developers can configure flows once, and non-technical staff can adjust steps using a visual builder.

With the current 621 data integrations, most insurance, communication, and finance tools connect without custom work.

Besides that, approvals, delays, and checkpoints keep automation predictable. Self-hosted options give complete oversight of where records live, which supports strong data security.

FAQs About AI for Insurance Agents

What is the best AI for insurance agents?

The best option supports customer engagement, integrates directly into your daily systems, and can work in the insurance value chain, such as Activepieces.

Will AI replace insurance agents?

No. AI mimics human intelligence and can perform tasks that are normally done by insurance agents, but it can’t replace judgment, trust, or advice.

How is AI being used in insurance agencies?

Insurance agencies use AI chatbots and virtual assistants to answer questions, route requests, and support clients, including in health insurance.

How to use AI to sell insurance?

AI helps agents respond faster, spot interest early, and keep conversations active so more deals move forward.