Entire Quarter of Time Saved: Funding Societies' Success Story with Activepieces

At Funding Societies (FS), the journey with AI didn’t start overnight.

A year ago, they celebrated a milestone. They launched their first loan application chatbot powered by large language models (LLMs), and it was very successful.

However, beneath the success was a serious challenge. Custom AI agents were great for high-impact tasks, but they weren’t scalable.

There were a lot of core, routine workflows that clearly needed automation, but this meant piling more projects for the already overwhelmed engineering teams.

FS needed a way to solve this problem without hiring an army of engineers.

A New Chapter: Discovering Activepieces

Funding Societies wanted to extend automation capabilities outside of just Engineering or IT but at the same time, they needed robust security, compliance, and technical flexibility.

So, they set out with a clear wish list.

It looked like this:

- The ability to create complex, robust integrations when needed.

- A tool so easy to use that a sales manager or support lead could automate tasks themselves.

- Native AI features for natural language processing (NLP), document processing, content generation, and other AI use cases

- Rock-solid security and compliance, which is a must-have for a fintech company.

That’s when Funding Societies found Activepieces, an AI-first, open-source, and no-code automation platform designed for both technical and nontechnical users.

Business Impact Across FS

This initiative was launched in Q1 of this year and here are some of the results they saw:

- Saving teams almost a quarter of a year in time that would otherwise be spent on manual tasks

- Significant qualitative benefits including error reduction, improved communication, and reduced context switching

- Over 100 automation flows deployed across the organization

Around 60 team members from across all departments actively participated in the project, creating and implementing their own automation solutions. Activepieces had successfully unlocked a self-serve AI automation culture throughout Funding Societies.

Here are some of the automations that had the most impact:

1. AI-Powered Payment Document Review

Funding Societies implemented an AI-powered document review workflow that automatically validates payment documents using OCR and language models. The system extracts data, verifies authenticity, and provides immediate feedback, while maintaining human oversight for complex cases.

This solution scales easily with transaction growth without requiring additional staff.

Results:

- Thousands of manual review hours saved annually

- Accelerated approval times, even as payment volumes grew

- Significantly improved customer experience through faster processing

- Maintained high standards in financial decision-making

2. Automated Document Generation

Manual generation of essential financial documents consumed time and were error-prone.

So they built an automation system now retrieves internal data, pre-populates fields, and produces properly formatted documents ready for client review.

Results:

- Enhanced client experience by ensuring all necessary documents are ready before disbursement

- Significantly reduced turnaround time for document preparation

- Markedly improved accuracy in document creation

- The sales team was free to focus more on high-value client interactions rather than paperwork

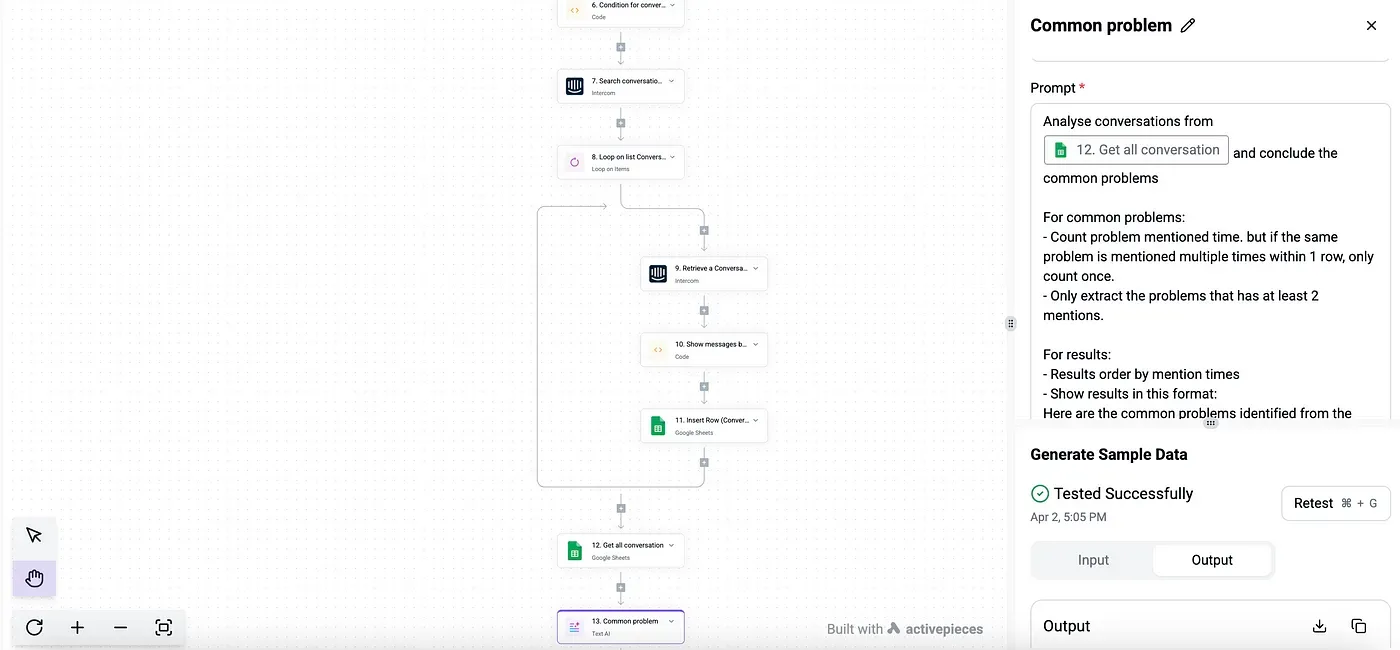

3. Automated Monthly Customer Insights

Another impactful workflow was the automated customer insight built by the product design team to analyze Intercom conversation data. It transformed a 1-3 week manual task into an instant process. The system extracts conversations, uses NLP to identify themes and pain points, and compiles reports that guide product development.

Results:

- Provided consistent, monthly customer feedback reports

- Enabled more data-driven, responsive product development

- Captured a broader range of user sentiment compared to traditional surveys

- Freed customer experience and engineering teams from time-consuming analysis tasks

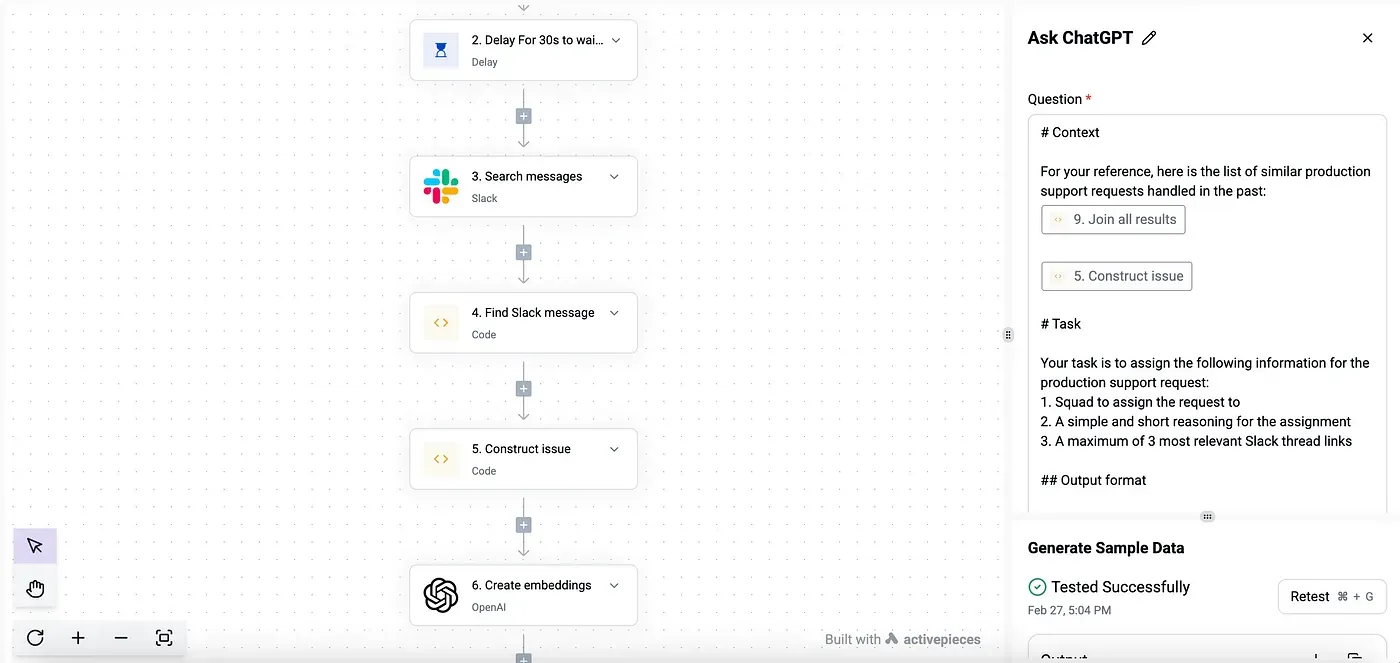

4. Intelligent Support Triage

Support operations at Funding Societies now use AI automation with Retrieval-Augmented Generation (RAG) to automatically triage and route support requests.

The system stores all past requests in a vector database that continuously improves, analyzing new requests against historical data to assign them based on expertise, capacity, and past resolution patterns.

Results:

- Enabled instant, 24/7 triage, including after hours and holidays

- Freed engineers from manual triage tasks

- Scaled to handle unlimited query volume without extra staffing

- Achieved continually improving routing accuracy through automated learning

- Delivered faster issue detection and resolution by assigning the right experts immediately

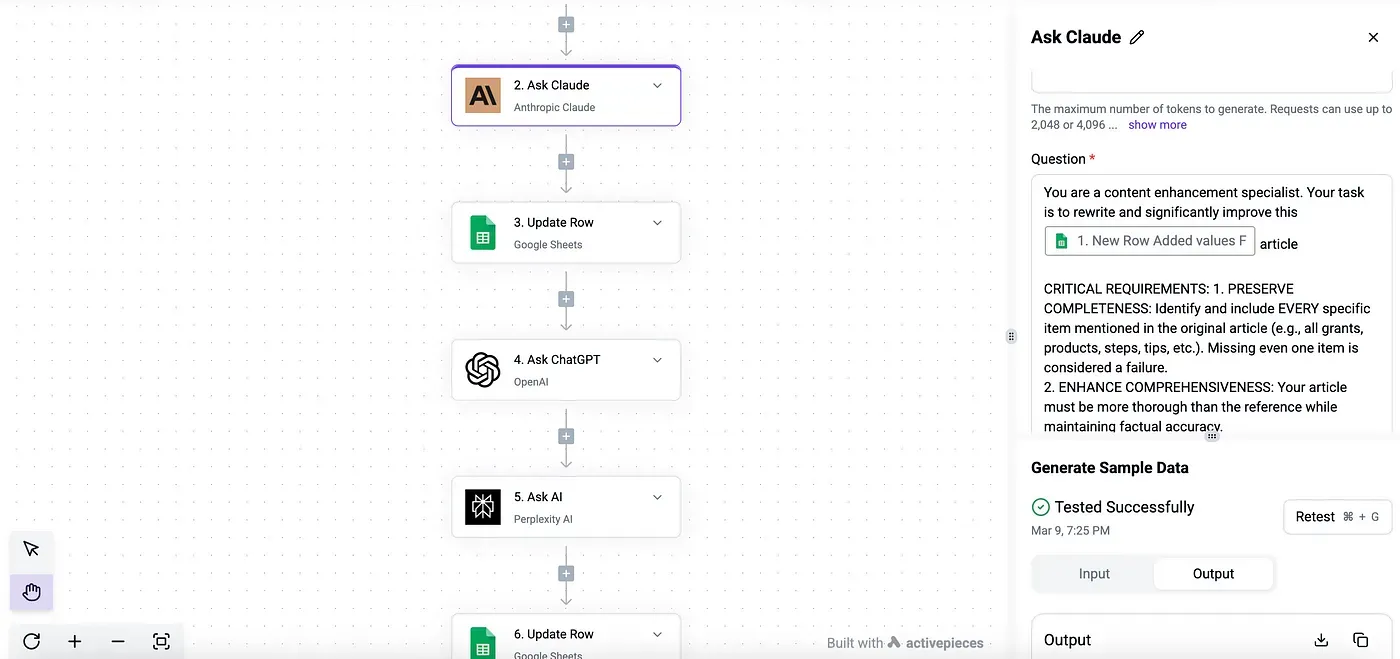

5. Content Production

The content team built AI automation systems to enhance and repurpose top-performing articles for targeted keywords.

This process identifies high-potential topics from search data, analyzes leading articles, extracts successful concepts, and generates fresh content aligned with financial guidelines. The flow also includes FAQ formatting optimized for AI search engines.

Results:

- Reduced content production time by 85% (from half a day to under 30 minutes)

- Achieved significant cost savings per article

- Increased organic traffic metrics by 20–30% through dual optimization

- Maintained consistent brand voice across all content assets

Building an AI-First Culture

Since launching Activepieces, Funding Societies has rolled out over 100 automation flows, saving entire quarters' worth of collective team time that would have been spent on manual tasks.

But it goes beyond that:

- Fewer errors, better communication, and less mental context switching.

- Teams now approach workflows with an “AI-automation first” mindset and always think of ways to innovate with automation

Activepieces: Loved by Technical and Non-Technical teams

Funding Societies’ story is a reminder that the barriers to business transformation aren’t always technical; they’re often about culture, access, and who gets to participate.

Activepieces transformed Funding Societies into a fintech company with faster operations, more prepared than ever to do what matters most: help their clients thrive.

If you are inspired by their story, you can start by creating a free Activepieces account here: https://activepieces.com/